Personal and property tax records are one of those documents that usually have to be analyzed carefully to get more than the very basic information from them. Property taxes document land ownership and tax payment (usually)–they don’t guarantee residence on the property.

Personal tax records usually document financial value over a given threshold and usually document residence within the location where the tax was assessed–unless the individual had personal property within the assessed region and lived somewhere else. That’s possible, but individuals are likely to live where they have personal property assessed.

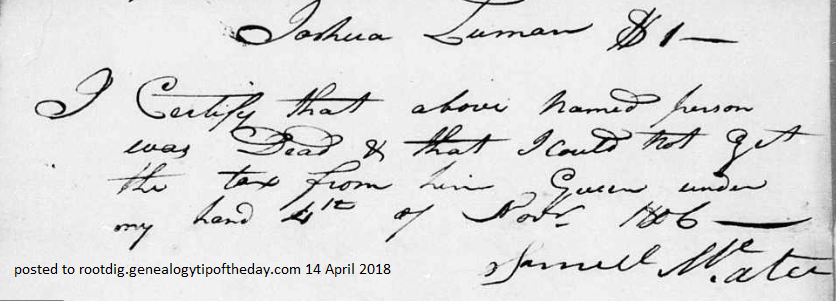

On 4 November 1806 a local tax collector in Bedford County, Pennsylvania, indicated that he was unable to collect the tax from Joshua Luman because Joshua was dead. Tax records don’t always document deaths in this fashion, but some times they do.

No responses yet