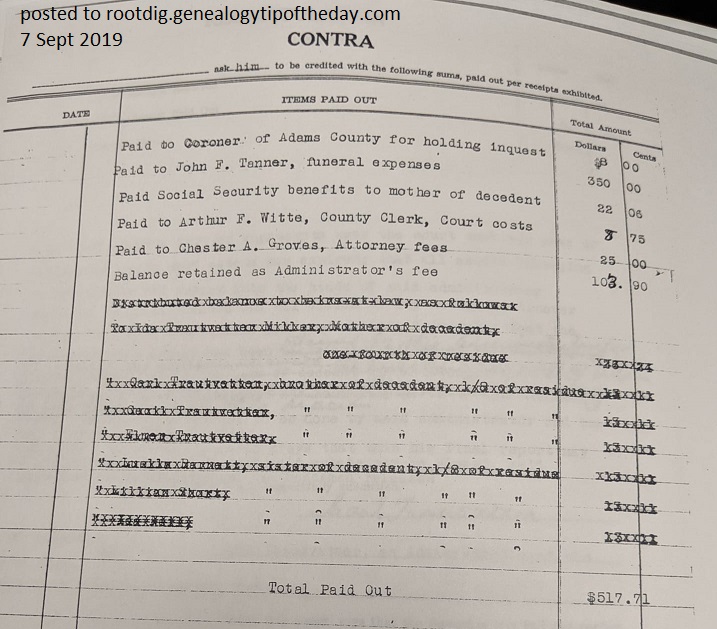

The list of disbursements in the 1938 final accounting of the John J. Trautvetter estate contains an inordinate number of “x”s. Over half of the disbursements were effectively eliminated before the report was filed.

The disbursements that have been cancelled were to John’s family. He died in Quincy, Adams County, Illinois, in 1937 leaving his mother and his siblings as his only heirs-at-law. The crossed out section of payments reference those disbursements and reads, when overlooking the crossouts:

Distributed balance to heirs-at-law, as follows:

To Ida Trautvetter Miller, Mother of decedent, one-fourth of residue $26.24

To Carl Trautvetter, brother of decedent, 1/8 of residue $13.11

To Cecil Trautvetter, [ditto marks indicating same share and relationship as Carl] $13.11

To Elmer Trautvetter,

[ditto marks indicating same share and relationship as Carl] $13.11To Luella Barnett, sister of decedent, 1/8 of residue $13.11

To Lillian Short, [ditto marks indicating same share and relationship as Luella] $13.11

To Ida Neil, [ditto marks indicating same share and relationship as Luella] $13.11

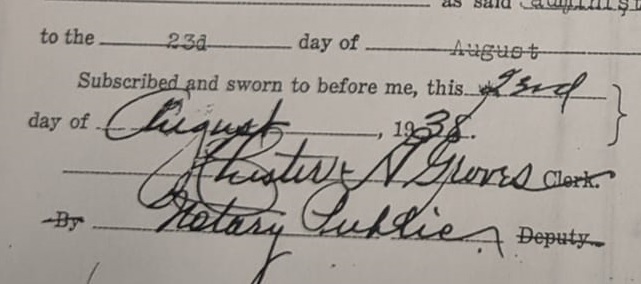

Carl Trautvetter, the administrator of John J. Trautvetter’s estate, signed the list of disbursements on 23 August 1938. It was witnessed by Chester A. Groves, who signed as a notary. The list of disbursements was completed on a form pre-printed for the express purpose of settling an estate and was apparently normally to be signed before a clerk in the Circuit Clerk’s office. Groves has crossed out the pre-printed “Clerk” on the form and the word “Deputy” and replaced it with “Notary Public.” Chester A. Groves was also the lawyer for the Trautvetter estate as indicated in the list of disbursements where he received a $25 payment for his services.

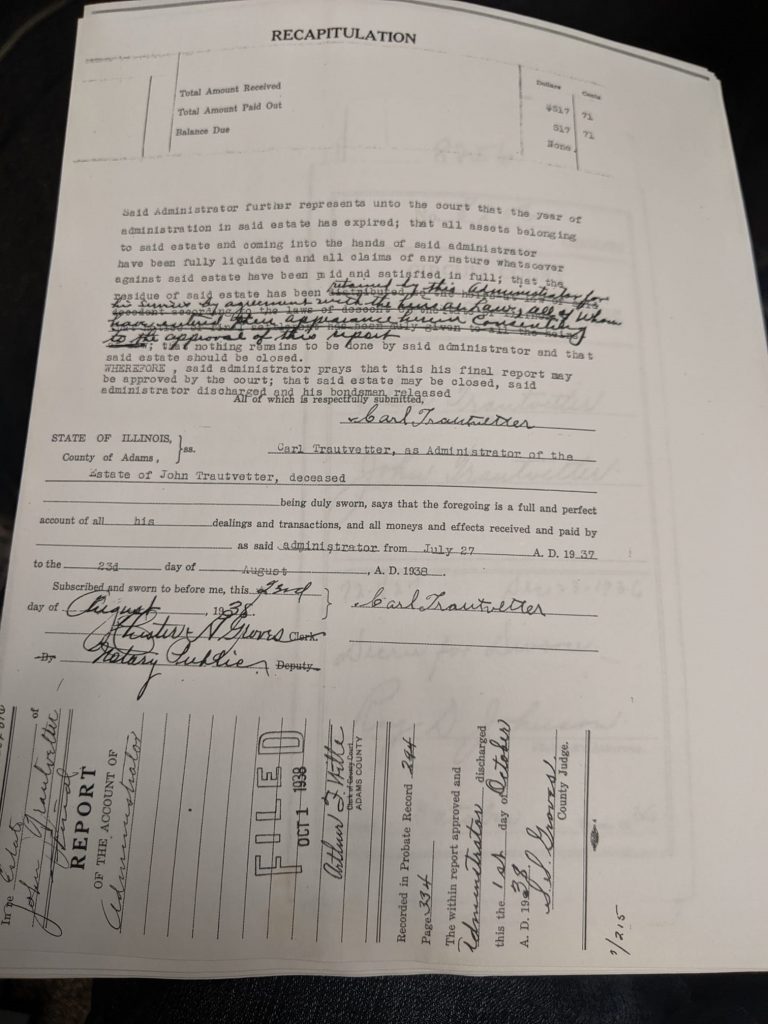

The request of Trautvetter to have the list of disbursements approved by the court and have himself released from his duties as administrator makes the reason for the crossouts a little more apparent. What likely happened is that a clerk in Groves’ office typed up the form before Trautvetter signed it. It most likely was completed a while before Trautvetter signed it and before the family had made a decision.

The section of Trautvetter’s request to have the estate closed initially included a phrase indicating that the bills of the estate had been paid and that the balance should be distributed to the heirs-at-law based upon the laws of descent in effect in Illinois. That phrase has been crossed out. It has been replaced with a handwritten statement requesting that the balance of the estate be retained by the administrator for his services and that this change has been agreed to among the heirs-at-law who have given their consent and approval to the report.

So at some point before Trautvetter signed the petition to close the estate, his mother and siblings agreed that he should receive what was left over. Illinois state statute indicated how the heirs were to receive property. Trautvetter was survived by six siblings and his mother and, under contemporary Illinois law, his mother would receive a share twice as large as her children. That’s why she would have received 1/4th of his estate (2/8ths) and his siblings would have received 1/8th of his estate.

If they had not agreed to let their brother have the balance. If heirs can agree, they can sometimes override what statutes dictate–if they can agree. That doesn’t always happen.

But typists in the 1930s who don’t want to retype documents that need correcting often use cross-outs. After all, there is no whiteout.

2 Responses

No white out was a plus in this case. Look at what you’ve leaned.

Exactly. It was relatively easy to read through.